Protecting Our Client's Legacy

Thursday 11th of February 2021.

Following the Office for Tax Simplification report of Inheritance Tax in 2019 and the All-Party Parliamentary Group report into Inheritance Tax Reform, there has been much speculation that changes to what happens to your estate on death may be forthcoming.

Regardless of whether there are changes announced in the March 2021 Budget or even the anticipated November 2021 Budget and also whether your estate will be subject to Inheritance Tax, it is really important that you plan for your legacy (however big or small) and that you make sure all of your affairs are in order.

For such planning, there is no time like the present.

During the current coronavirus pandemic, I am sure we all know someone who has suffered ill health or died prematurely.

The following sets out three actions that you should consider now.

- Leave a well-written Will and avoid intestacy

- Create a lasting power of attorney

- Engage with a probate and estate administration provider

Leave a well written Will and avoid intestacy

It is no secret that it is so important to leave an up-to-date Will with clear instructions on how you would like your estate to be dealt with when you pass away. This ensures that your estate is distributed in line with your wishes and your loved ones rightfully inherit your legacy. Furthermore, a Will makes the process of handling your affairs, known as “estate administration”, easier for your loved ones and prevents unnecessary stress at an already difficult time.

What’s often less well understood is how your estate will be distributed if you do not create a Will. There are common misconceptions about who will inherit, especially regarding step-children and partners who are not married.

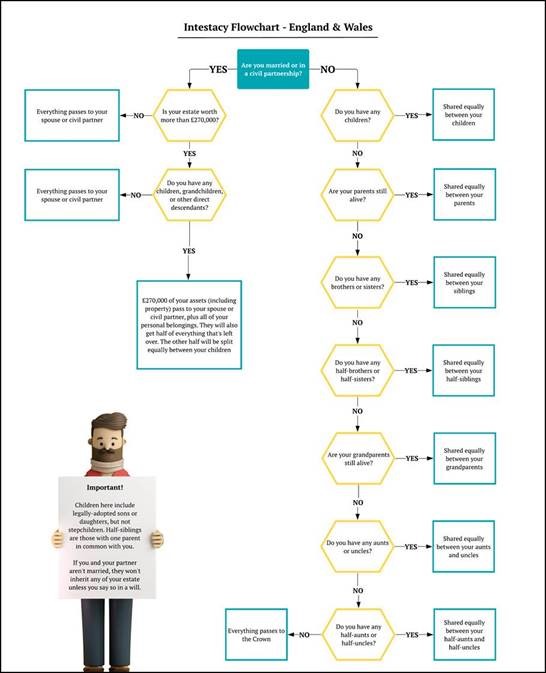

There are different rules of intestacy for England and Wales, Scotland and Northern Ireland. The following flow chart shows what happens in England and Wales.

Create a lasting power of attorney

Creating a lasting power of attorney (LPA) is often not thought about until we get older or gradually become ill. Less than 1% of the adult UK population has an LPA, according to the Office of the Public Guardian (January 2021).

An LPA is a document that allows a person, known as the “donor”, to give one or more people, the ‘attorney(s)’, the legal authority to make decisions on their behalf. This would apply if the donor ever lacks the physical or mental capacity to make decisions for themselves.

Again, it is often misunderstood how little you can do with a loved one’s assets without an LPA. If you do not have one in place:

- You have no say in who the court appoints as your deputy

- You have no say in the scope of power granted to your deputy

- A deputy’s application could be refused, so the council may be appointed instead

- Your family will have to pay extra to apply for and maintain a deputyship

- You may not be able to sell jointly held assets until the court appoints a deputy

Engage with a probate and estate management provider

When you lose someone close to you, often the last thing you want to do is sort out the estate. However, estate administration is required after every death - whether or not there is a Will. It involves dealing with the deceased’s assets (such as property, shares and personal possessions), paying debts, paying any Inheritance Tax and Income Tax and transferring the inheritance to the beneficiaries of the estate.

A difficult time can often by made easier by using a professional service, who can take control of the following:

- Gathering information

- Prepared tax forms and applying for the Grant of Probate (Confirmation in Scotland)

- Closing accounts

- Completing the legal work

- Selling and transferring assets and paying debts

- Selling property

- Finalising tax work

- Producing estate accounts

Please note: by clicking this link you will be moving to a new website. We give no endorsement and accept no responsibility for the accuracy or content of any sites linked to from this site.